Understanding the Basics of Credit for Effective Money Management

By Mrs. B Finesse

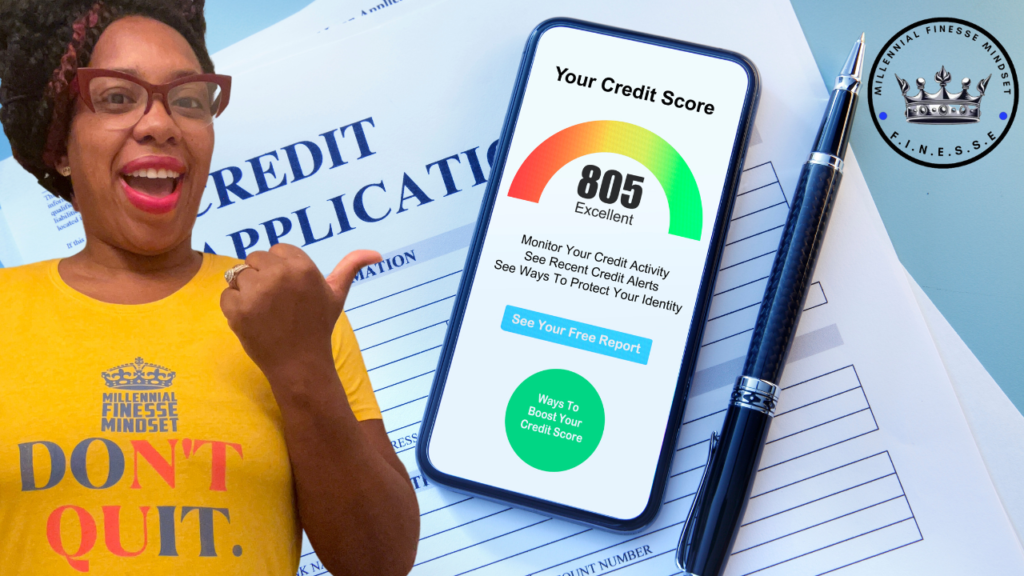

Are you one of the people who want to know exactly what your credit score is and how you can improve it? If so, in this comprehensive guide, we’ll explore the fascinating world of credit and its impact on personal finance and money management. Whether you’re just starting your financial journey or looking to improve your credit score, this guide will provide you with the essential knowledge and insights to navigate the complex realm of credit.

What is Credit?

Credit is a fundamental component of the modern financial system. It represents your ability to borrow money or access goods and services with the promise to repay the amount owed in the future. When you use credit, you essentially borrow funds from a lender or creditor, agreeing to repay the borrowed amount along with any applicable interest or fees.

The Importance of Credit

Building a Solid Financial Foundation is KEY! Credit plays a crucial role in various aspects of our lives, from securing loans and mortgages to leasing a car or even renting an apartment. By establishing and maintaining a good credit history, you unlock a world of financial opportunities. A positive credit profile not only helps you access favorable interest rates and loan terms but also reflects your financial responsibility and reliability. A SECRET many don’t know about credit is that you can be denied a job because of bad credit in 39 states and the District of Columbia, while 11 states ban the practice in most cases.

Types of Credit

Credit comes in various forms, each serving different purposes. Let’s explore some common types of credit:

- Credit Cards: These plastic wonders offer a convenient way to make purchases and build credit. When you use a credit card, you’re basically borrowing money from the card issuer, with the expectation of paying it back later.

- Loans: Whether it’s a personal loan, auto loan, or student loan, borrowing money from a financial institution allows you to make significant purchases or invest in your education. Loans typically have fixed repayment terms and interest rates. Make sure to read all the fine print for the loan you choose.

- Mortgages: A mortgage is a long-term loan used to finance the purchase of a home. It usually involves a large sum of money and extended repayment periods.

Decoding the Three-Digit Number

Your credit score is a numerical representation of your creditworthiness. It’s a three-digit number that helps lenders assess your credit risk and determine whether to approve your loan applications. The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850.

Factors that influence your credit score include:

- Payment History: Timely repayment of loans and credit card bills is crucial to maintaining a good credit score.

- Credit Utilization: The amount of credit you use compared to your available credit limit impacts your score. It’s recommended to keep your credit utilization below 30%.

- Length of Credit History: The length of time you’ve had credit accounts affects your score. A longer credit history demonstrates stability and responsible credit management.

Tips and Strategies for a Strong Credit Profile

Building and maintaining good credit requires consistent effort and responsible financial habits. Here are some essential tips to help you on your credit-building journey:

- Pay Your Bills on Time: Late payments can hurt your credit score. Set up reminders or automatic payments to ensure timely bill payments.

- Keep Credit Utilization Low: Aim to use only a portion of your available credit to maintain a healthy credit utilization ratio.

- Monitor Your Credit Reports: Regularly review your credit reports from the major credit bureaus (Equifax, Experian, and TransUnion) to check for errors or fraudulent activity.

- Diversify Your Credit: Having a mix of credit accounts, such as credit cards, loans, and a mortgage, can positively impact your credit score.

In this Beginner’s Guide to Credit, we’ve covered the fundamental aspects of credit and its significance in personal finance and money management. By understanding the basics of credit, types of credit, credit scores, and strategies for building and maintaining good credit, you’re equipped with the knowledge to make informed financial decisions and achieve your financial goals.

Remember, credit is a powerful tool that, when used responsibly, can open doors and provide financial flexibility. Make credit work for you by practicing good money management habits and staying watchful about your credit profile.

Embrace the Millennial Finesse Mindset by being a proactive planner, taking control of your finances, and watching your savings grow steadily towards a brighter future with more money. Focus on Faithfully Innovating, Inspiring others, being Naturally Effective, and Seek Success Everyday!